The Single Strategy To Use For Succentrix Business Advisors

The Single Strategy To Use For Succentrix Business Advisors

Blog Article

Unknown Facts About Succentrix Business Advisors

Table of ContentsUnknown Facts About Succentrix Business AdvisorsThe Ultimate Guide To Succentrix Business AdvisorsThe Buzz on Succentrix Business AdvisorsSuccentrix Business Advisors Things To Know Before You BuyNot known Details About Succentrix Business Advisors

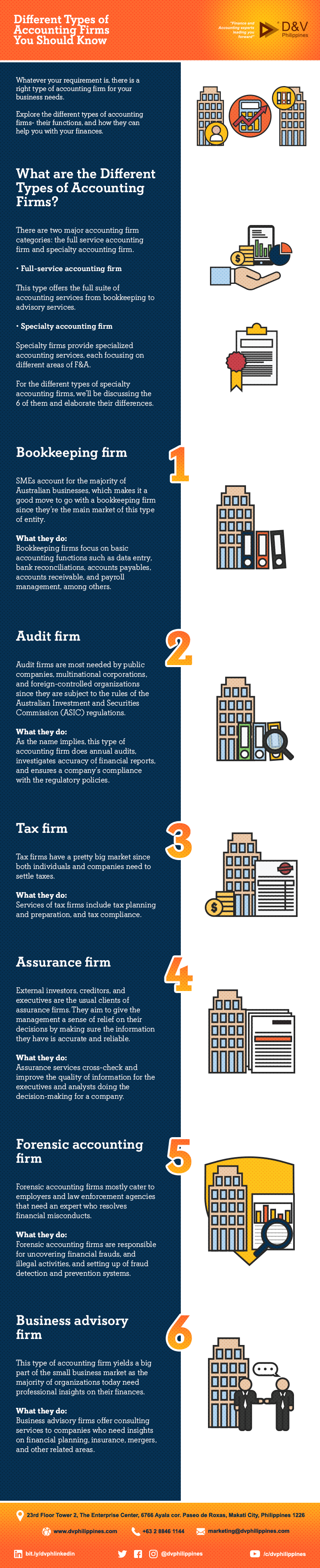

The structure and capacities of the company depend on scale and variety of services. Accounting firms intend to provide quality services that assist services and people manage their financial resources and make sound choices regarding their money.CAS firms focus on advisory bookkeeping solutions as opposed to a compliance-heavy solution. However, what precisely is it? Find out more below! By now, you've probably become aware of CAS, CAAS, advising bookkeeping, accounting and advising servicesor whatever you want to call it! This fad in the audit sector shifts to a concentrate on advising accounting services instead than a compliance-heavy solution.

Let's get our acronyms right. Currently that we understand what to call it, allow's discover regarding what it is! Historically, accounting businesses have actually been concentrated on the conformity side of things.

According to the & AICPA PCPS 2018 CAS Criteria Survey Record, the 5 most usual client audit advisory services provided are: 1099 creation and filing (91%) Monetary statement prep work (89%) CFO/Controller Advisory services (88%) Accounts payable (86%) Sales tax returns (85%) As opposed to concentrating on just the nitty sandy i.e., taxes, transactions, and points that have actually already happened, CAS firms likewise concentrate on the future and attempt to assist their customers remain positive and make the very best choices for their organization holistically.

What Does Succentrix Business Advisors Do?

Conformity is the cake, and consultatory services are the icing on top.

CAS firms have to do with transforming the narrative concerning accountingyou're no longer marketing your time, you're selling your knowledge and competence. That's why CAS in accounting companies typically bill their clients ahead of time with a membership, or value-based rates CAS model, and rundown specifically what services their customers will be obtaining. This permits the audit firm to have year round money circulation and earn money prior to the job is done.

, CAS in accountancy firms are reported a median development price of 16% over the previous year reported by the 2022 AICPA PCPS and CPA.com Management of an Accounting Technique (MAP) firm benchmarking research study. Canopy is a one-stop-shop for all of your accounting firm's needs. Sign up free to see exactly how our full suite of solutions can aid you today.

Running a service entails a great deal of accounting. It's a necessary component of organization operations. You do it everyday, also if you're not familiar with it. Whenever you record a purchase, prepare tax obligation documents, or prepare an expenditure, audit is included. You have to do some degree of accounting to run a service, whatever.

The Ultimate Guide To Succentrix Business Advisors

If you're not considering recordkeeping and accountancy, the odds are that your records are a mess, and you're hardly scraping by. Accountants do so a lot, and they do it with competence and performance. That makes a big difference for a service. Obviously, accountancy is a large field, and audit solutions can consist of many different things.

Bookkeeping is regarding generating exact financial records and maintaining reliable recordkeeping techniques. Bookkeepers additionally function to create financial declarations for evaluation. All of this falls under accounting, yet an accountant can supply a lot a lot more economic guidance than a person whose role falls totally under accounting or recordkeeping.

State-licensed accountants (Certified public accountants) are most usually contacted to prepare financial declarations for companies or to aid with tax declaring at the individual or service degree. Accountant aid people to browse tax obligation guidelines and tax returns, and they often help services and people targeted by tax audits. Federal, state, and regional government entities operate a various scale than a lot of organizations.

Our Succentrix Business Advisors Diaries

Satisfying these requirements calls for specialized accountancy skills. Management accounting is the kind that most commonly comes into play for tiny organizations.

Report this page